Retirement planning

Social Security Strategies

Why it is important to talk About social security

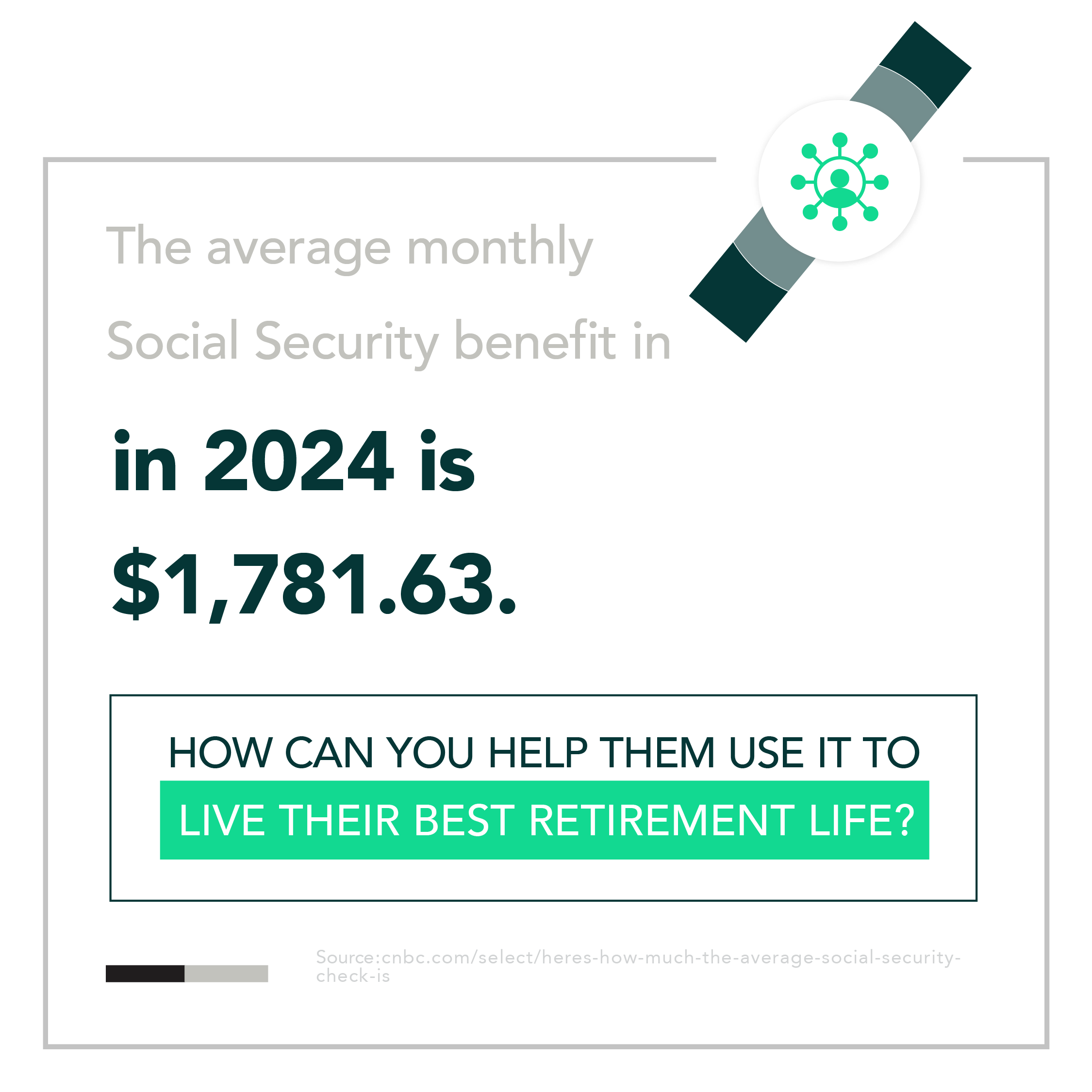

Did you know that 60% of Americans plan to rely on Social Security as their primary source of income, and that as of 2025, the average monthly Social Security benefit in 2024 is $1,781.63? This reflects a $49 increase from the 2024 average of $1,927, due to a 2.5% cost-of-living adjustment (COLA)2 that took effect in January 2025. With numbers like these, the need for a comprehensive financial plan has never been greater.

Bringing Social Security into high-level retirement planning conversations can enhance the client experience, build trust, and help set you apart from the competition.

Social Security Strategies Could Benefit Your Clients

Incorporating Social Security claiming strategies into retirement planning gives clients a clearer picture of what they can expect in retirement. In a time when every dollar matters, helping them avoid surprises demonstrates your knowledge, strengthens trust, and can foster long-term client relationships.

Approaching The Conversation

Starting the conversation doesn’t need to be complicated. A simple question like:

“Have you estimated your Social Security benefits?” can open the door.

With tools available directly through the Social Security Administration’s website, you can quickly help clients calculate their expected benefits. Without being a Social Security expert, you can position yourself as a valuable guide—helping clients see how Social Security fits into the bigger retirement picture.